Campbell Global Acquires Over 250,000 Acres Of Timberland

Campbell Global, a wholly-owned timber investment manager of J.P, Morgan Global Alternatives, has acquired over 250,000 productive acres of high-quality, commercial timberland across three properties in the Southeastern U.S.—valued at over half a billion dollars.

The properties will be continuously managed for both carbon capture and timber production to meet growing demand for sustainable building products and other uses. The properties encompass over 18 million metric tons of stored CO2 equivalents (mtCO2e), including more than half a million mtCO2e net retained carbon in 2021 alone. The properties have approximately 120 million standing trees, and over 250,000 acres of diverse wildlife habitat for recreational pursuits.

“This transaction is one of the largest of its type in the past decade and builds on efforts to expand our asset class offering across alternatives by offering investors access to a robust carbon sequestration and timber management platform,” comments Anton Pil, Global Head of J.P. Morgan Global Alternatives. “We are committed to harnessing the extensive forest management expertise of Campbell Global to offer our clients the unique ESG benefits associated with timberland assets.”

Campbell Global was acquired by J.P. Morgan Asset Management in August 2021.

Latest News

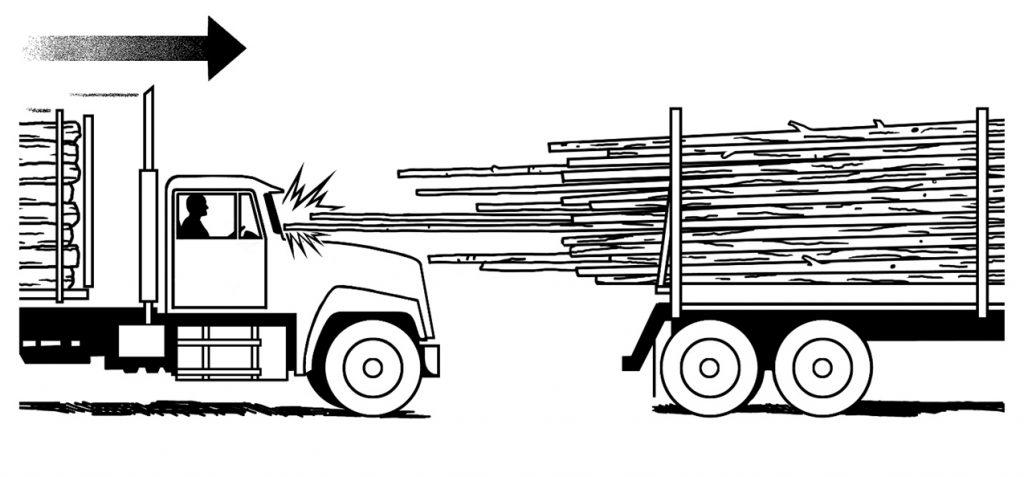

Following Too Closely

BACKGROUND: Two truck drivers, each driving a loaded log truck with pulpwood that had a large amount of overhang, traveled together during the daytime to deliver their loads to the same mill located in the South. The weather was overcast, but visibility was good. It...

Beck Group, Forest2Market Announce Sawmill TQ Service For Southern Sawmills

The Beck Group (Beck) and Forest2Market, Inc. recently announced a partnership to launch Sawmill TQ (Top Quartile), a new service for gathering and delivering Southern Yellow Pine sawmill benchmark data to industry members. The partnership combines Beck’s sawmill...

Have A Question?

Send Us A Message